Automotive Insurance

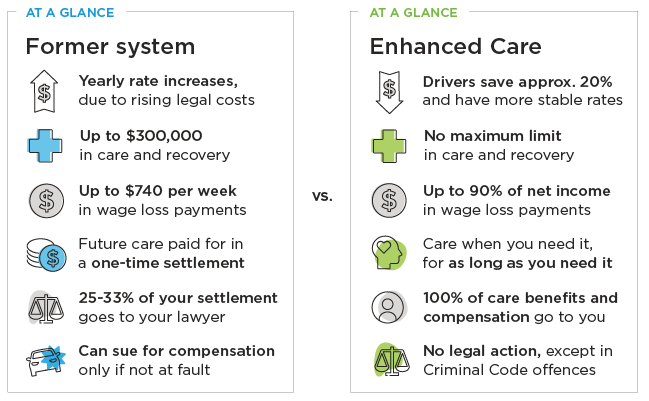

Whether you own an existing vehicle or you’ve just bought a new one, make sure you and your vehicle have the proper protection. No one ever starts their day thinking they will get into an accident but there are over 700 motor vehicle accidents reported in BC every day. Every driver in British Columbia is required to purchase ICBC Basic Autoplan Insurance. Most drivers also choose to increase their coverage with either ICBC Optional Insurance or coverage from another insurance provider.

Our insurance experts will be happy to answer any questions you may have and help you decide what coverage is best for your insurance needs. Call or visit a Sussex Insurance office near you.